ESMA guidelines on funds’ names using ESG or sustainability-related terms

This update concerns EMSA’s latest guidelines publication to establish harmonized criteria for use of ESG and sustainability terms in fund names. Our main takeaways are set out below.

Background

The evolving scene of sustainable investments has created a need for investor protection. On this basis, the European Securities and Markets Authority (“ESMA”) was mandated to develop guidelines on naming funds, to combat unfair or misleading marketing. After the proposed guidelines in December 2023, the ESMA has subsequently published their final report on guidelines on funds’ names using ESG or sustainability-related terms on the 14th of May 2024.

Key proposals

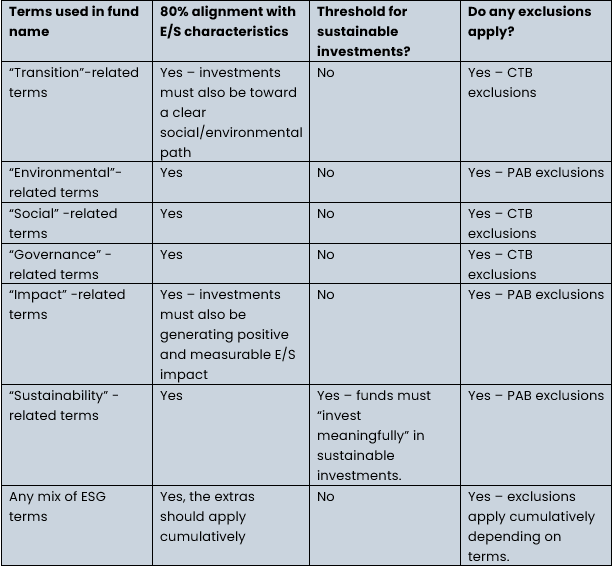

The proposed guidelines affect all existing and upcoming funds that have names containing, or closely linked to any of the following terms: sustainability, transition, impact, environment, social, governance, or a mix of said terms. All fund names containing the terms must follow certain requirements, as follows:

80% alignment of ESG term requirement

- The threshold is linked to the proportion of investments used to meet such ESG characteristics or sustainability objectives in accordance with the binding elements of the investment strategy, which are to be disclosed in the pre-contractual agreements under the commission delegated Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (“SFDR”)

- If the fund does not disclose under the SFDR it is unclear what would be sufficient to meet the sustainability characteristics.

Minimum sustainable investment requirements

- If the fund name contains “sustainable” or similar terms, the fund is required to make a minimum of sustainable investments. The original quantitative threshold was dropped before the final report which now states that funds must commit to “invest meaningfully” in sustainable investments referred to in Article 2(17) of the SFDR.

- It is for now unclear what “invest meaningfully” entails.

Exclusions

- All funds whose name contains the ESG-related terms should exclude investments in companies referred to in Article 12(1)(a) to (c) (the “CTB” exclusions”) of CDR (EU) 2020/1818.

- If the fund name contains terms related to environment, impact or sustainability the fund must exclude investments in companies referred to in Article 12(1)(a) to (g) (the “PAB” exclusions”) of CDR (EU) 2020/1818.

For further information, please click here.

Fund-name matrix

Subsequent phaes

The guidelines on fund’s names will apply three months after the date of the publication of the guidelines on ESMA’s website in all EU official languages.

Managers of any new funds created after the date of application of the guidelines should apply these guidelines immediately in respect of those funds.

Managers of funds existing before the date of application of these guidelines should apply these guidelines in respect of those funds after six months from the application date of the guidelines.

Permian recommendation: AIFM’s whose funds are set up, or invest, in the EU, that contain any of the above ESG and sustainability terms should ensure compliance with the guidelines.