Our Story

Founded in Norway in 2008, Permian has rapidly grown into a leading fund service provider with strong Nordic roots.

Over the years, we have built a strong presence in the Norwegian and Swedish markets, partnering with some of the largest players in the investment management industry.

Our offering spans the full range of services for AIF funds and their managers, supporting asset classes such as Private Equity, Venture Capital, Family Offices, Real Estate, Infrastructure, Private Debt and SPVs.

With centrally located offices in Oslo and Stockholm, and further expansion ahead, we continue to strengthen our international footprint.

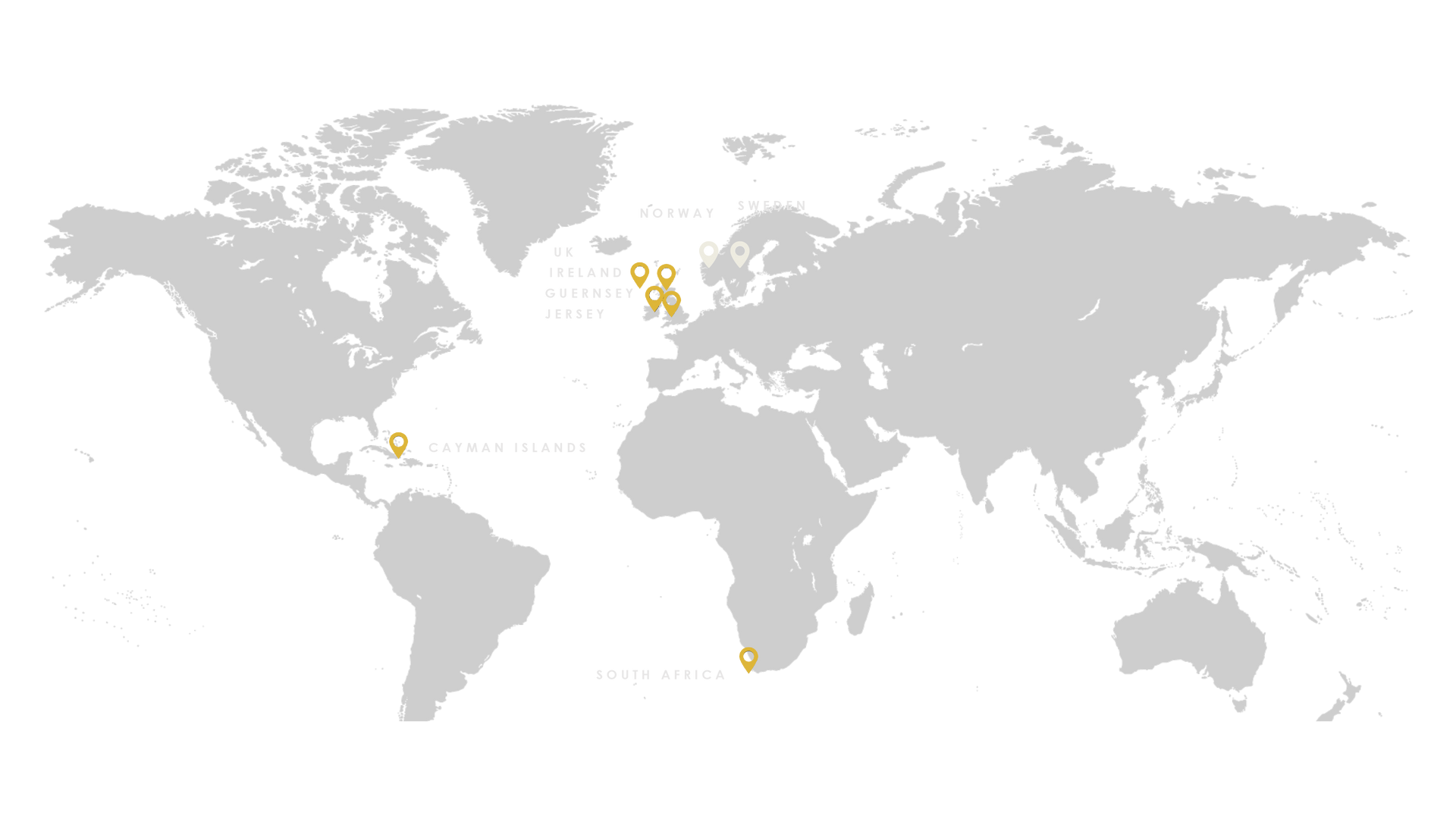

In mid-2025, we merged with HIGHVERN, an award-winning provider of private wealth, fund and corporate administration services.

Together, we form a team of 300+ professionals across the Nordics, the Cayman Islands, Guernsey, Ireland, Jersey, South Africa and the UK.

This expanded network enables us to share expertise across markets and deliver the advantage of both local insight and global reach.

Backed by long-term family capital and a shared ambition to deliver best-in-class fund services, we remain committed to precision, quality and care in everything we do.

Precision is our DNA

Our culture is shaped by an entrepreneurial mindset, professionalism, team work and a strong commitment to precision and quality. Working with complex investment structures requires the highest level of accuracy. This principle guides the way we work and support our clients. Our culture come to life in our three company values: Precise, Caring and Challenging.

Precise

Caring

Challenging

News about Permian

Our Key Contacts

Marianne Normann

+47 416 92 662

mn@permian.no

Susanne Berge Hansen

+47 975 21 191

sbh@permian.no

Axel Høvo Daasvand

+47 911 82 765

ahd@permian.no

International Platform for Fund Services together with HIGHVERN

Following our merger with HIGHVERN in mid-2025, we now serve our clients locally across eight jurisdictions.

Permian

Highvern

Sustainable Finance

and SDGs

Long term value creation

Permian believes that high standards in the areas of environment, social responsibility and corporate governance (ESG) as well as sustainable development goals (SDGs) are a prerequisite for the group to be able to contribute to long-term value creation in companies and attract the best talents.

EU has made demands for transparency, classification and reporting for fund activities, including the Disclosure Regulation (SFDR) and the Taxonomy Regulations (TR). These requirements have a major impact on clients who are fund managers and their funds. Most of our clients are subject to these regulations and Permian has gained a lot of practical insight into the new legislation through our support across many clients.

Permian works with continuous development of operational experience, solutions and expertise in sustainable finance. Through this, Permian assists customers in operationalizing the relatively large set of guidelines, frameworks and reporting requirements within this area.

Permian focuses on 4 of the 17 SDGs from the UN. Through this, we seek to help achieve the goals for the Paris Agreement.

The Transparency Act (åpenhetsloven)

The Transparency Act Annual Assessment

The Transparency Act entered into force 1 July 2022. The aim of the Act is to promote firms' respect for fundamental human rights and decent working conditions in connection with the production of goods and the provision of services and ensure the general public access to information regarding how enterprises address adverse impacts on fundamental human rights and decent working conditions.